If you have yet to file your federal tax return, you may be wondering if you should rush to get it done or ask for more time.

But one of the more common misconceptions around tax time concerns extensions.

An extension will indeed give you until October to finish filing, but the problem is that your tax bill is still due if you owe any money. Amanda Monroe is among those hoping to be done filing by the tax deadline of April 18 so she doesn't have to file for an extension.

"The deadline is coming," she said. "But I have started!"

Why you should avoid an extension, if possible

Mark Steber of Jackson Hewitt says extending your tax return is rarely a good idea.

"It's an extension of time to file your paperwork, not to pay your taxes, not to kick the can down the road," he explained.

But there are certainly reasons for some people to do it, he says, especially if you are missing some documentation.

"The only people that really need to extend are those that really are awaiting some final documentation from a transaction, a partnership, an S Corp, or K-1 perhaps," he said. "But all of those were required by law to be out already."

If you're still waiting for documents, Steber says don't delay by continuing to wait. Chances are they were sent out but were sent to the wrong address, so take action by contacting your employer or another issuer.

How to request an extension

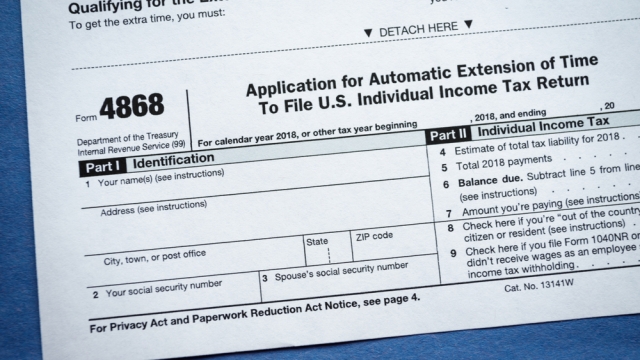

To request an extension, fill out IRS Form 4868 for a no-questions-asked, six-month extension.

But even if you plan to file an extension, Steber says to estimate how much you owe in taxes and get something to the IRS by midnight of April 18.

"Or you will face late filing penalties, perhaps a late payment penalty, an underpayment penalty, plus interest and the cost to clean it all up on top of that," he said.

One exception this year: the IRS extended the tax deadline for residents in several disaster areas in states like Arkansas, California, and Mississippi.

As for Monroe, she's determined to have everything ready April 18.

"I'm gonna get it done, yes," she said.